3 Biotech Stocks That Could More Than Triple if Their Trials Succeed

Biotech investing is often a high-risk, high-reward game, with clinical trial results capable of sending stocks soaring or plummeting. For investors willing to bet on scientific breakthroughs, these three companies with intriguing pipelines have the potential to generate massive rewards if their trials are successful.

Biotech Stock #1: Astria Therapeutics

The first on the list is Astria Therapeutics (ATXS), a clinical-stage biotech company dedicated to developing innovative therapies for rare allergic and immunologic diseases.

Valued at $476.9 million, Astria stock is down 7.3% year-to-date, compared to the broader market gain of 13%.

The company currently has no approved products. However, its lead program, navenibart, is a monoclonal antibody inhibitor of plasma kallikrein. It is currently in Phase 3 clinical studies for the treatment of hereditary angioedema (HAE), a rare genetic condition that causes recurring and unpredictable swelling episodes. Astria expects to receive top-line results from the ALPHA-ORBIT Phase 3 trial in early 2027. Astria has also collaborated with Kaken Pharmaceutical on the development and commercialization of navenibart in Japan.

In the second quarter, research and development expenses rose to $25.9 million, reflecting higher costs related to Navenibart’s Phase 3 trial and other pipeline efforts. As a result, Astria recorded a net loss of $33.1 million in the quarter, or $0.57 per share. At the end of Q2, Astria had cash, cash equivalents, and short-term investments totaling $259.2 million, which included the Kaken upfront payment and estimated Phase 3 cost reimbursements. This strong financial position is intended to support Astria’s operating plan through 2028, which includes the completion of the ALPHA-ORBIT and ORBIT-EXPANSE trials for navenibart, as well as the ongoing Phase 1a trial for STAR-0310.

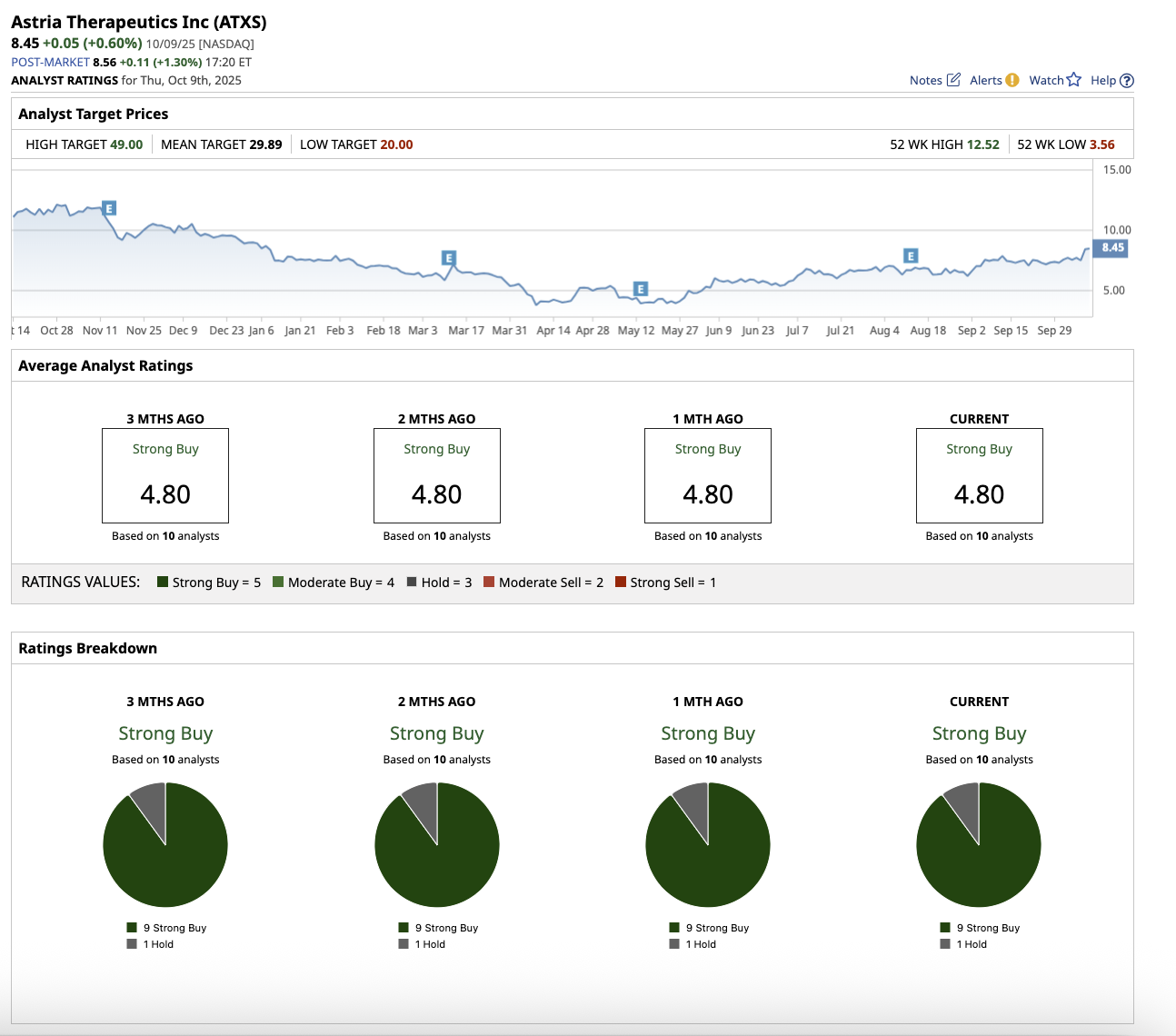

Overall, the consensus for Astria stock is a “Strong Buy.” Among the 10 analysts covering the company, nine give it a “Strong Buy” rating, and one suggests holding. The average price target of $29.89 indicates potential 253.7% upside from current levels. Meanwhile, the high price target of $49 implies the stock could surge by as much as 479.8% over the next year.

Biotech Stock #2: Avalo Therapeutics

The second stock on my list is Avalo Therapeutics (AVTX), a clinical-stage biotechnology company devoted to developing interleukin-1 beta (IL-1β)-targeted therapies for immune-mediated inflammatory diseases. The company’s focus remains sharply on advancing AVTX-009, its lead therapeutic candidate, through the ongoing Phase 2 LOTUS trial for hidradenitis suppurativa (HS), a chronic, progressive inflammatory skin disorder characterized by painful nodules and abscesses.

Valued at $196.9 million, Avalo’s stock has surged 91.5% YTD, compared to the overall market gain.

Avalo expects to finish enrollment for the Phase 2 study by the end of 2025, with top-line results expected in mid-2026. These findings will provide vital insights into AVTX-009’s potential and assist in determining readiness for a Phase 3 development program. The company recorded a net loss of $20.8 million in the second quarter, owing to higher R&D investment. Avalo now has a healthy financial position, with cash, cash equivalents, and short-term investments totaling $113.3 million as of Q2. This financial foundation is intended to maintain operations until 2028, giving the company plenty of time to execute its clinical strategy.

If not treated properly, HS can cause tissue deterioration, scarring, and a significant loss of quality of life. AVTX-009 attempts to diminish inflammation at its source, which may affect the clinical course in individuals with HS and other similar disorders. A successful trial might move the firm closer to developing a new therapy option for people with HS and other chronic inflammatory disorders.

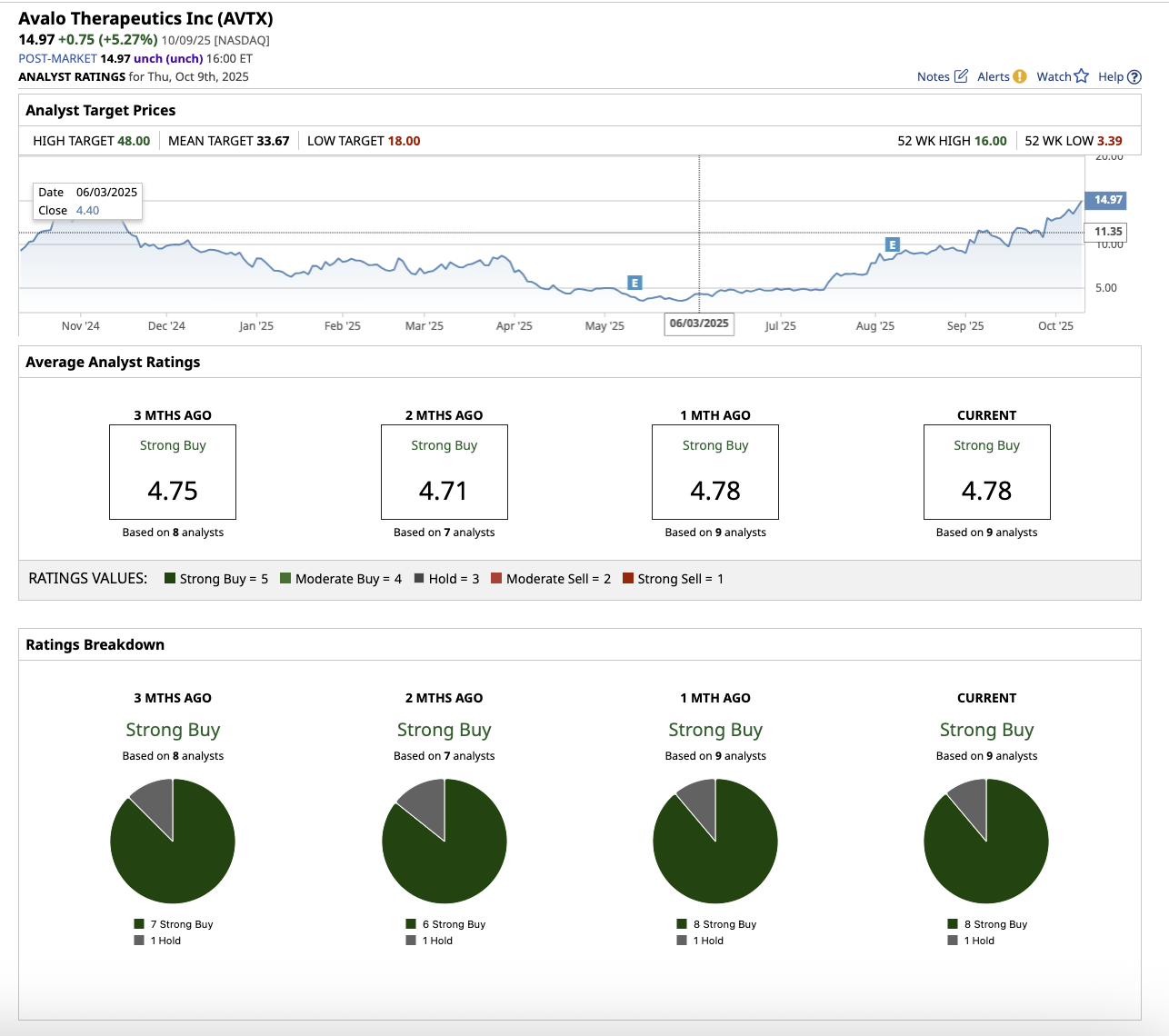

Overall, the consensus for Avalo stock is a “Strong Buy.” Among the nine analysts covering the company, eight give it a “Strong Buy” rating, and one suggests holding. The average price target of $33.67 indicates potential 125% upside from current levels. Meanwhile, the high price target of $48 implies the stock could surge by as much as 220.6% over the next year.

Biotech Stock #3: Gossamer Bio

The third clinical-stage biotech company on my list is Gossamer Bio (GOSS), which focuses on developing innovative therapies for pulmonary diseases, particularly pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD).

Valued at $582.1 million, Gossamer stock is up 155.9% YTD, compared to the broader market gain.

Pulmonary arterial hypertension is a serious, progressive condition marked by high pulmonary arterial pressures and right heart failure, which frequently leads to poor long-term prognosis. The company is working on seralutinib, an inhalation medication that aims to stop and potentially reverse pulmonary vascular remodeling, which is a major cause of PAH.

Gossamer has completed enrollment of the Phase 3 PROSERA clinical trial and plans to share the study's top-line results in February 2026. If the trial is successful and regulatory submissions proceed smoothly, seralutinib has the potential to become a multi-indication franchise, given the drug’s intriguing mechanism and unmet requirements in PAH therapy.

The global collaboration between Gossamer Bio and Chiesi Group is key to the company’s growth strategy. Under this partnership, Gossamer leads development efforts in the U.S., while Chiesi is responsible for commercialization outside of the U.S. In the second quarter, revenue from the collaboration totaled $11.5 million. At the end of Q2, Gossamer Bio held cash, cash equivalents, and marketable securities totaling $212.9 million. The company expects this financial position to be sufficient to support operations and capital expenditures into 2027, providing a stable runway for ongoing clinical trials and commercialization planning. Gossamer Bio stands at a pivotal point in its development from a clinical-stage biotech to a fully fledged commercial organization.

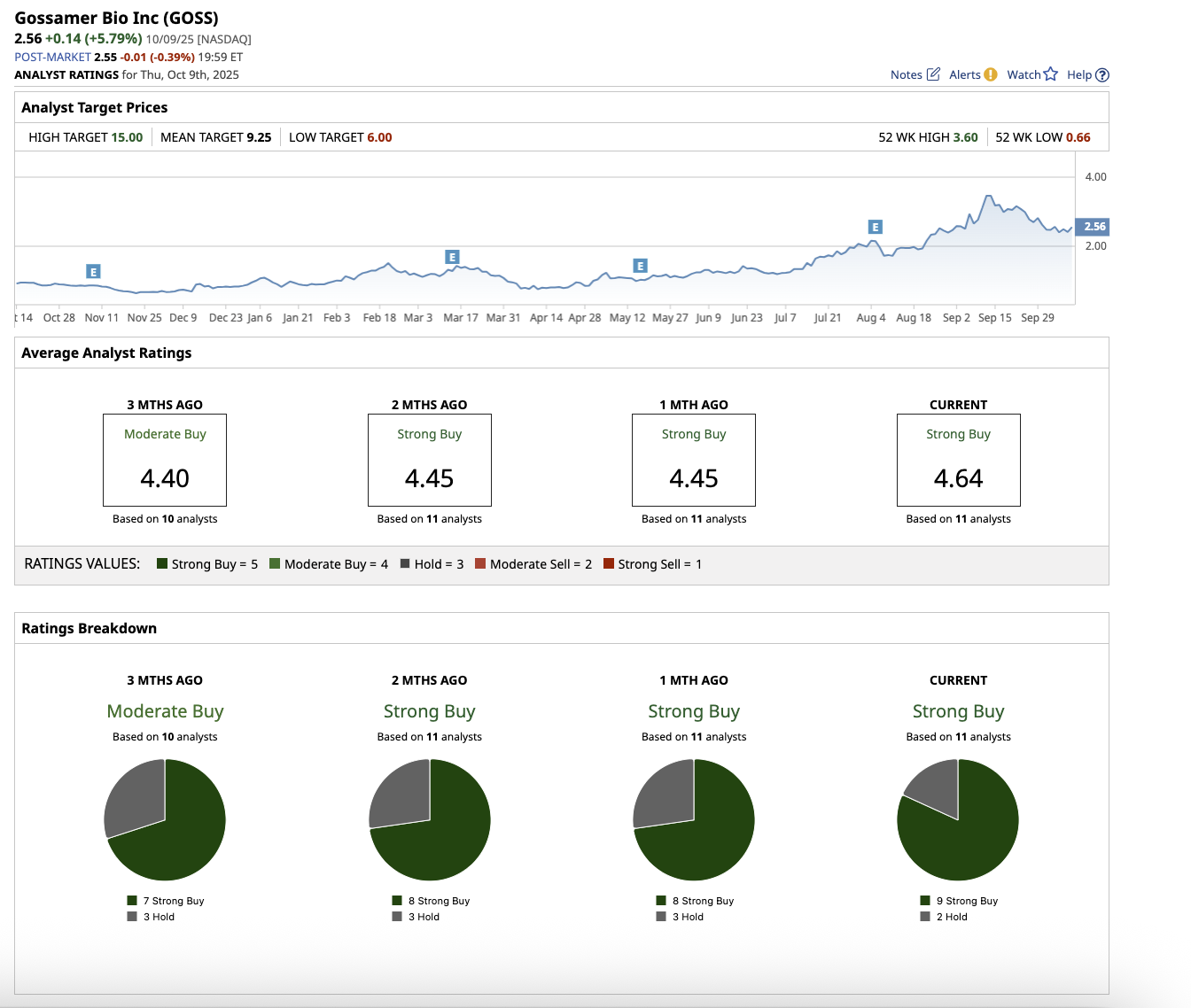

Overall, the consensus for Gossamer stock is a “Strong Buy.” Among the 11 analysts covering the company, nine give it a “Strong Buy” rating, and two suggest holding. The average price target of $9.25 indicates potential 261.3% upside from current levels. Meanwhile, the high price target of $15 implies the stock could surge by as much as 486% over the next year.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.